04. How to Sell Short on Bybit

Sell Short means selling in anticipation of a drop in the price of a particular stock that wants to trade. This is an investment method that allows investors to make a profit even in the downturn market.

Bybit offers three types of derivatives:

USDT Perpetual (USDT indefinite contract) : There is no expiration date, and trading with a tether as collateral

Inverse Perpetual : There is no expiration date, and you trade coins as collateral

Inverse Futures : Expiration Date Exists (expiry date), Cleanses within the time limit, and trades coins as collateral

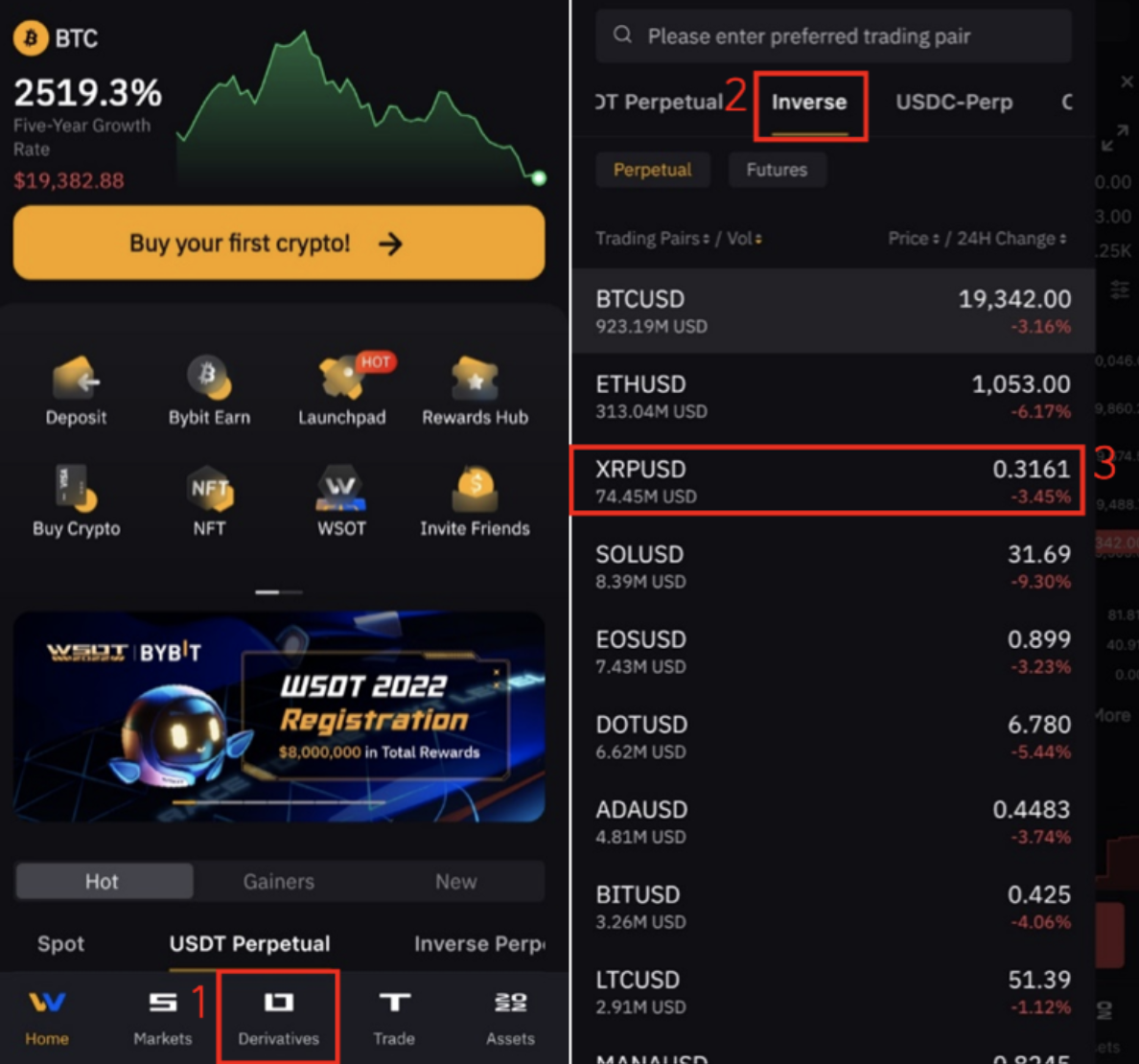

Select Derivatives from the Bybit Exchange Home and choose the right product for you.

Below is an example based on the Inverse perpetual contract.

Inverse Perpetual is a contract trading USD with coins as collateral. Since it is a method of trading USD using coins, you can see profits only when the price falls.

1. Select Trading Pair

Below is an example based on Ripple (XRP).

Click Derivatives ➡︎ XRPUSD

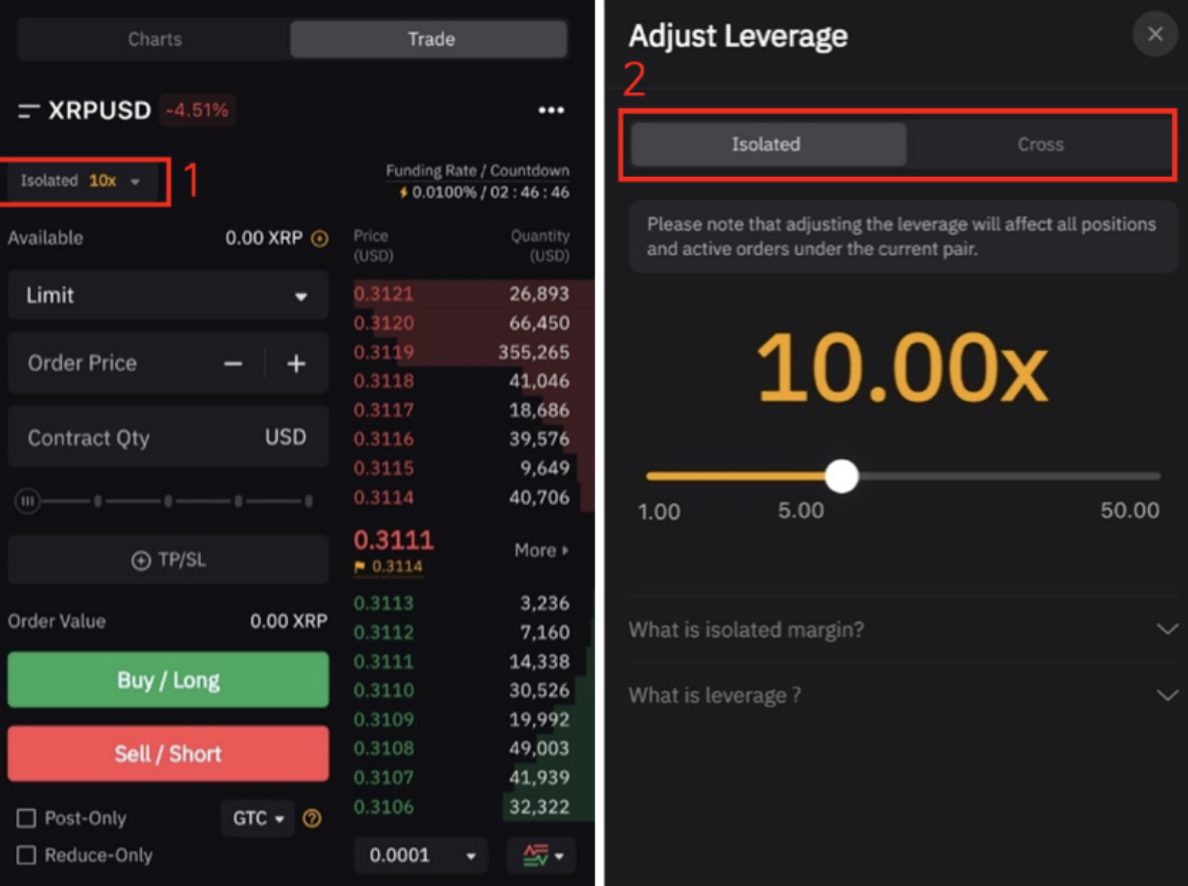

2. Order - Isolated Cross and Leverage Adjustments

Select the desired Margin Mode Isolated / Cross

Cross Margin Mode is less likely to cause liquidation because it holds assets as collateral in addition to the amount of investment, there are risks of full liquidation of assets.

Isolated Margin Mode only holds the amount of investment as collateral, it loses only the amount of investment in forced liquidation, but it is more likely to be forced liquidation.

Leverage Adjustment and Investment Amount

※ Leverage: Holding assets as collateral and borrowing money or coins from the exchange to invest

Leverage varies depending on the type of coin. As an example, Ripple (XRP) can be up to 50x.

Leverage means how many times the amount of coins you invest in will be borrowed. For example, if you invest 10 ripple (XRP), you can invest 500 ripple (XRP) if you set a maximum of 50 times leverage.

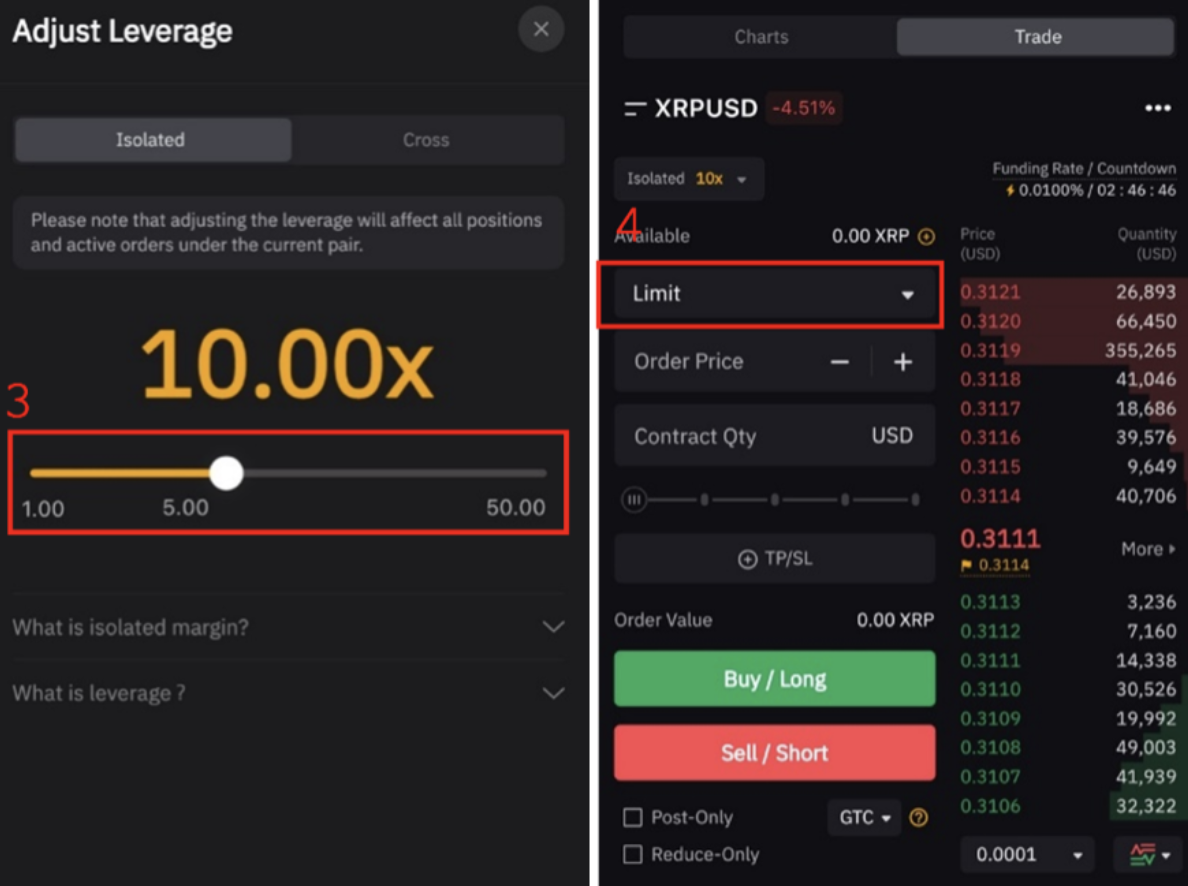

Adjust the isolation/crossing method and the leverage level

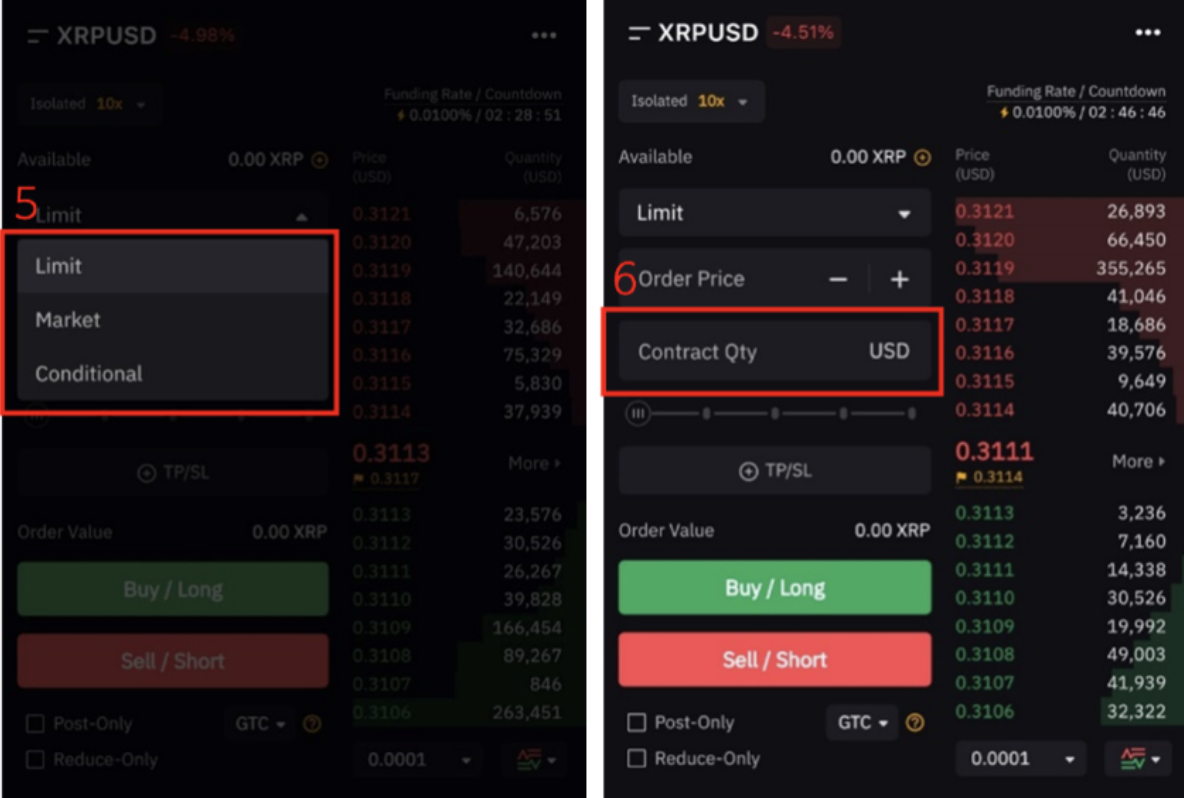

3. Select Order Type - Limit / Market / Conditional

Limit Orders specify a price and orders are placed when the market price reaches that price.

Market orders are placed at the current market price.

There are two types of Conditional Orders offered by Bybit.

Conditional Limit Price Orders

Once the price reaches the trigger price, the order will be placed in the call window at the price you specify. You can set the trigger value when you order at a specified price.

Conditional Market Price Orders

A conditional order can be understood as an additional market price order, in which the order is placed at the market price when the price reaches the trigger price.

4. Monitor & Close Position

Click Sell/Short to close the position.

You can exit by selecting Close By Limit or Market in the Position column at the bottom of the page.

Set the price and quantity to be liquidated at the end of the limit. Enter only the quantity to be liquidated at the end of the market.

|

2021년 해외코인거래소 순위 및 추천 |

|||

|

|

|

|

|

|

거래량 |

11조(1위) |

3.5조 |

9.5조 |

|

레버리지 |

최대100배 |

최대100배 |

최대125배 |

|

수수료 |

- 지정가 : 0.02% - 시장가 : 0.04%(1위) |

- 지정가 : -0.025% - 시장가 : 0.075% |

- 지정가 : -0.025% - 시장가 : 0.075% |

|

거래방법 |

현물+선물+마진 |

선물+주식+FOREX |

선물 |

|

회원가입

|

|||

|

할인코드

|

|||