21. How to Use Grid Trading on Binance

Grid trading is a type of quantitative trading strategy. This trading bot automates buying and selling on spot trading. It is designed to place orders in the market at preset intervals within a configured price range.

Grid trading is when orders are placed above and below a set price, creating a grid of orders at incrementally increasing and decreasing prices. In this way, it constructs a trading grid.

Binance Grid Trading makes maximum profit in volatile markets when prices fluctuate within a specific range. Essentially, grid trading attempts to make profits on small price changes. Through quantitative trading, it helps you trade rationally and avoid FOMO(Fear of Missing Out) where possible.

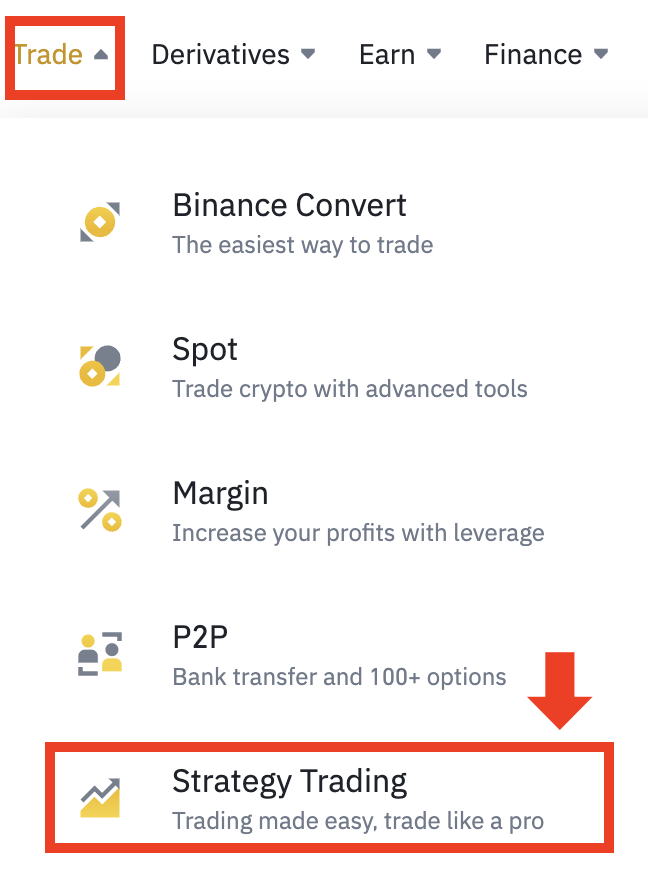

1. Log in to Binance ➡︎ Click [Strategy Trading]

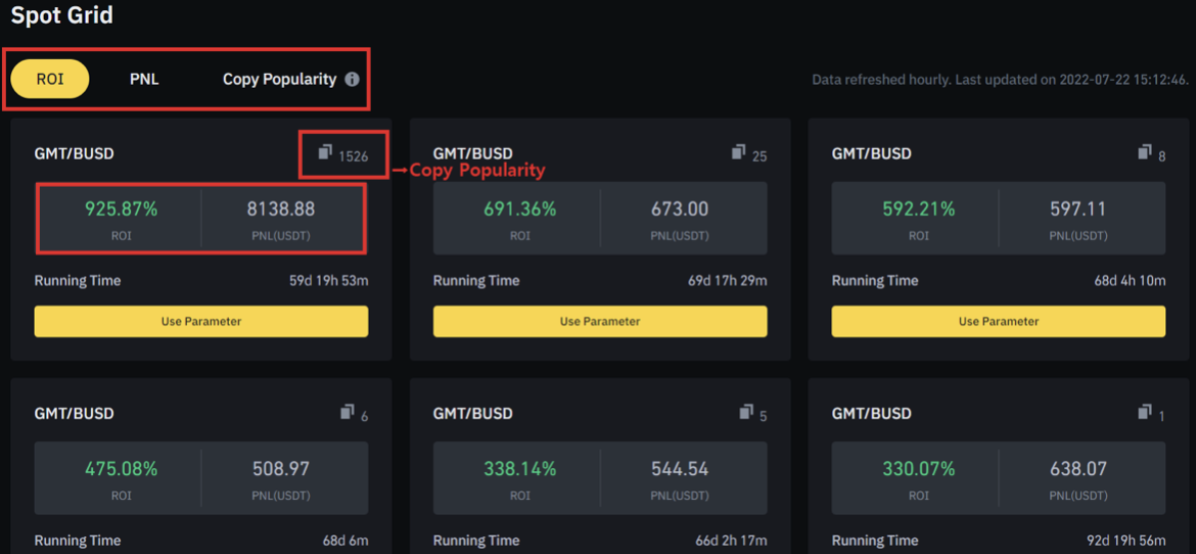

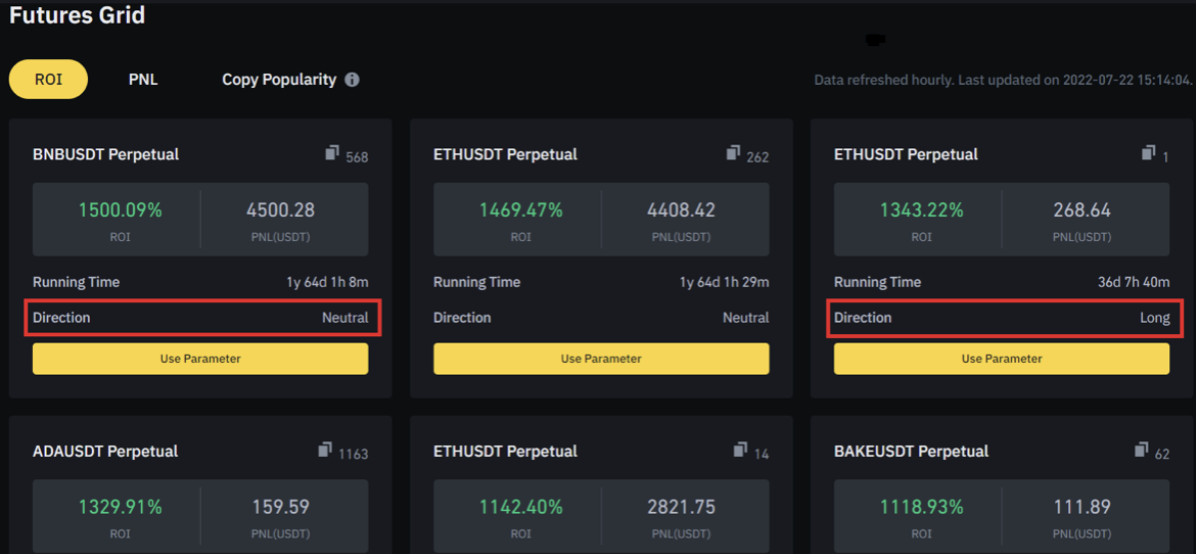

2. Select Spot/Futures Grid

Select the Grid that suits your needs. ROI means Return of Investment, PNL means Profit and Loss. Copy Popularity (numbers at the right corner) shows how many users copied the grid.

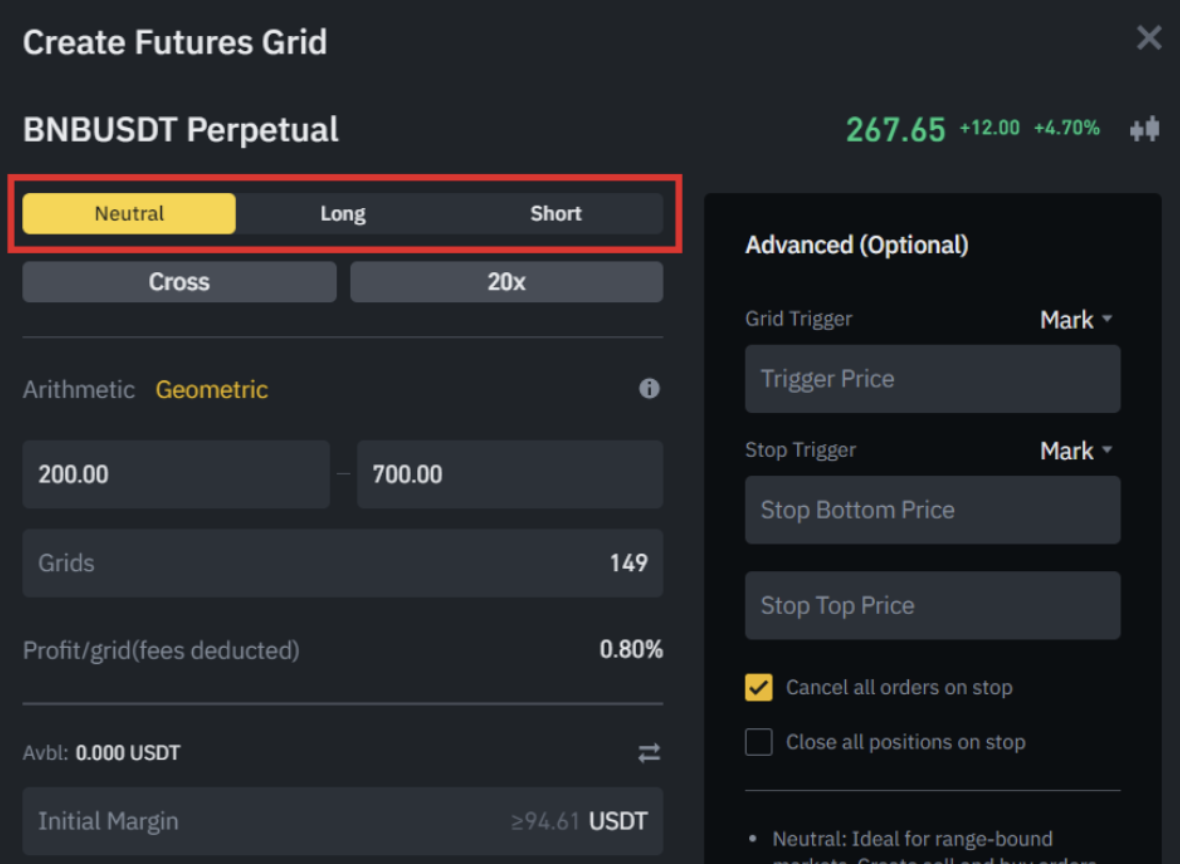

Futures Grid shows the Direction, unlike spot grids. There are 3 types of directions, Long/Short/Neutral. Long/Short directions open a position with the pre-set parameters, but Neutral doesn't have a position at the point of the order. It aims to buy low and sell high.

You can search using kewords such as Strategy Type, Market, Running Time, ROI, Zone.

3. Set Parameters

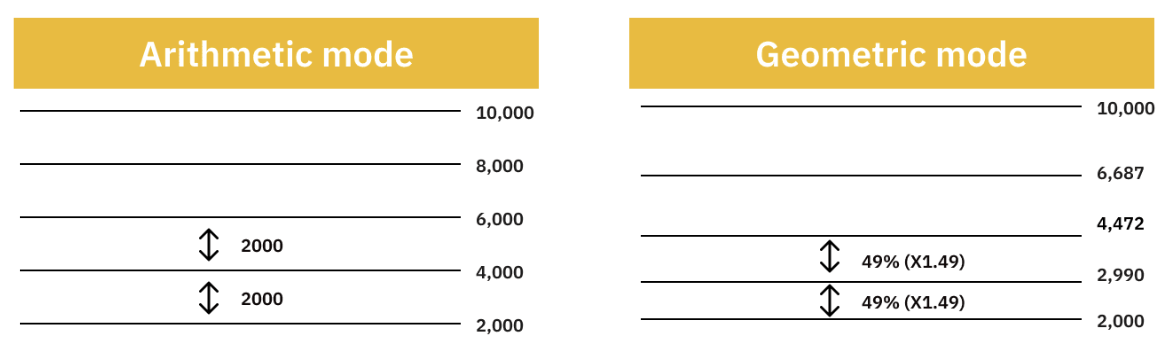

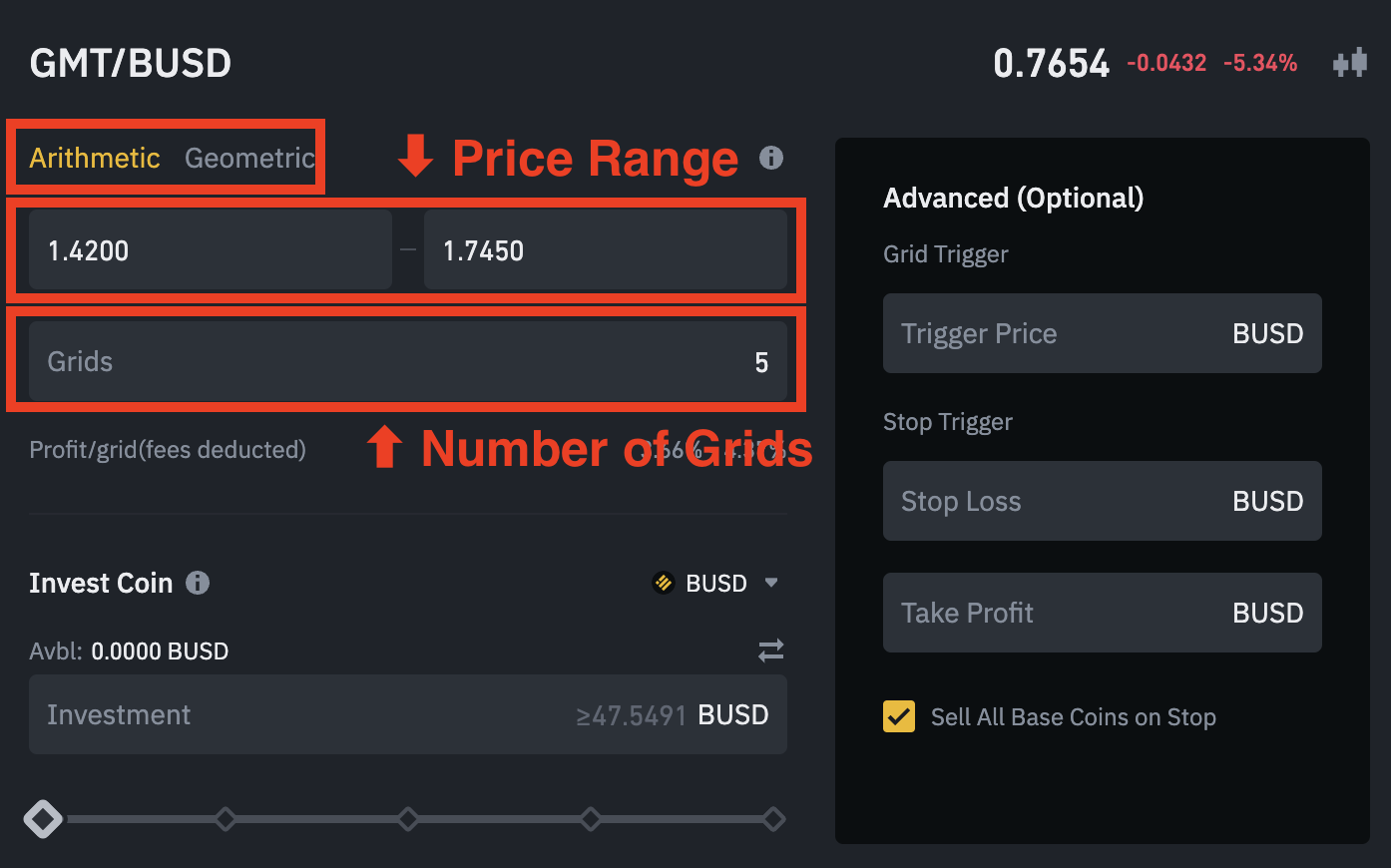

Select either the [Arithmetic] or [Geometric] mode.

Set the grid parameters, including the upper and lower price, grid number, and the coin to invest.

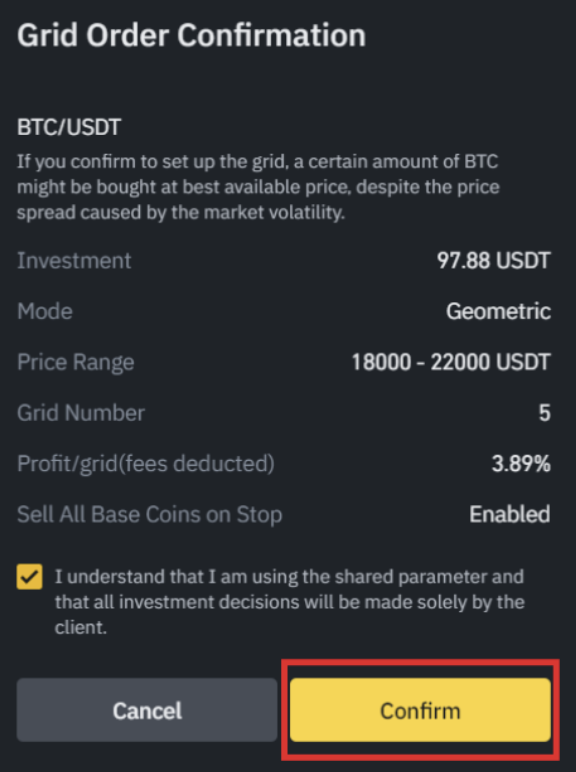

The system will calculate the minimum investment amount required based on the grid number and coin you selected. Enter the amount to invest and click [Create] to place your order.

Trigger Price

The grid orders will be triggered when the Last Price rises above or falls below the trigger price you entered.

Stop Trigger

You can use Stop Trigger to stop trading when the market price triggers the set prices:

Stop Loss: should be less than the lower price, last price and trigger price; when the latest market price reaches the Stop Loss price, the grid will stop working.

Take Profit: should be higher than the upper price, last price and trigger price; when the latest market price reaches Take Profit price, the grid will stop working.

Futures grids have positions, Neutral/Long/Short unlike spot grids.

4. Create Grid Bot

If you have more than one grid bot, it is possible to set the rankings at [Ranking Settings].

|

2021년 해외코인거래소 순위 및 추천 |

|||

|

|

|

|

|

|

거래량 |

11조(1위) |

3.5조 |

9.5조 |

|

레버리지 |

최대100배 |

최대100배 |

최대125배 |

|

수수료 |

- 지정가 : 0.02% - 시장가 : 0.04%(1위) |

- 지정가 : -0.025% - 시장가 : 0.075% |

- 지정가 : -0.025% - 시장가 : 0.075% |

|

거래방법 |

현물+선물+마진 |

선물+주식+FOREX |

선물 |

|

회원가입

|

|||

|

할인코드

|

|||