12. Double bottom, Double peak Trading Method

◆ Double bottom pattern

If you hit the bottom twice and hit the second bottom in a pattern called a double bottom or two-bottom, W pattern, and break through the previous high, you trade on the assumption that it will rise significantly.

As in the picture above, when the second floor is higher than the first floor, it is closer to a double-bottom pattern, and the probability of trading success is high as well.

◆ Double bottom trading method

Buying Timing: Timing of a big beekeeper when it hits the second bottom and rises above the previous high

◆ Increased chance of success

In addition, the probability is higher if the moving average is in a regular arrangement in the middle of a large beekeeper. The probability is slightly higher if the 3-bottom or 4-bottom pattern is not a double-bottom pattern.

cf. Spreading the moving average [Related]

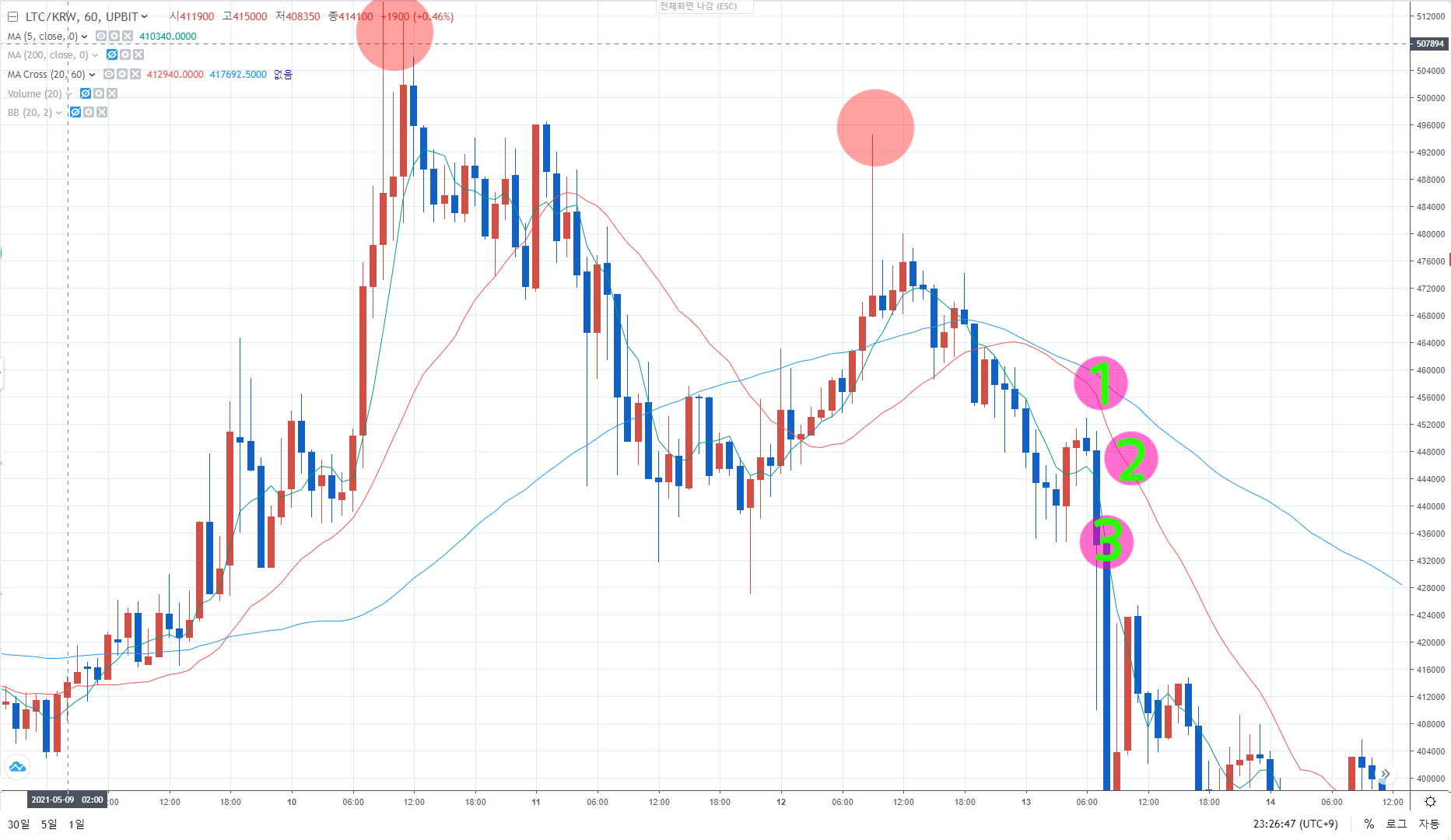

◆ Double peak pattern

The double peak pattern is traded on the assumption that the double bud (resistance line) is caught on the opposite side of the double bottom and descends and then breaks down the previous low.

◆ Double peak pattern

Sell Timing: Sell when a large black bar appears as it descends from the second peak and breaks through the previous low.

◆ Increase success rate

It is more probable if the moving average is inverted in the middle of a negative peak. A slightly higher probability in case of 3 or 4 patterns rather than doubles.

|

2021년 해외코인거래소 순위 및 추천 |

|||

|

|

|

|

|

|

거래량 |

11조(1위) |

3.5조 |

9.5조 |

|

레버리지 |

최대100배 |

최대100배 |

최대125배 |

|

수수료 |

- 지정가 : 0.02% - 시장가 : 0.04%(1위) |

- 지정가 : -0.025% - 시장가 : 0.075% |

- 지정가 : -0.025% - 시장가 : 0.075% |

|

거래방법 |

현물+선물+마진 |

선물+주식+FOREX |

선물 |

|

회원가입

|

|||

|

할인코드

|

|||