12. How to Use Futures Trading on Bybit

A futures contract is an agreement between two parties (long/short) to either buy or sell an asset, on a predetermined date, and price.

The contract tracks an underlying asset, in this case a cryptocurrency. It is basically a form of bet on the future price movement.

For example, if you believe that BTC will increase in price by the end of the month, you would be interested in opening a long position on the cryptocurrency by buying a Bitcoin futures contract with a monthly expiry date. Otherwise, you would go long, predicting price rise.

At the contract’s expiry date, the two parties involved in the trade settle, and the contract closes.

While a futures contract’s condition is to have an expiry date, there is a subcategory of cryptocurrency futures called perpetual contracts. Perpetual contracts does not have an expiration date.

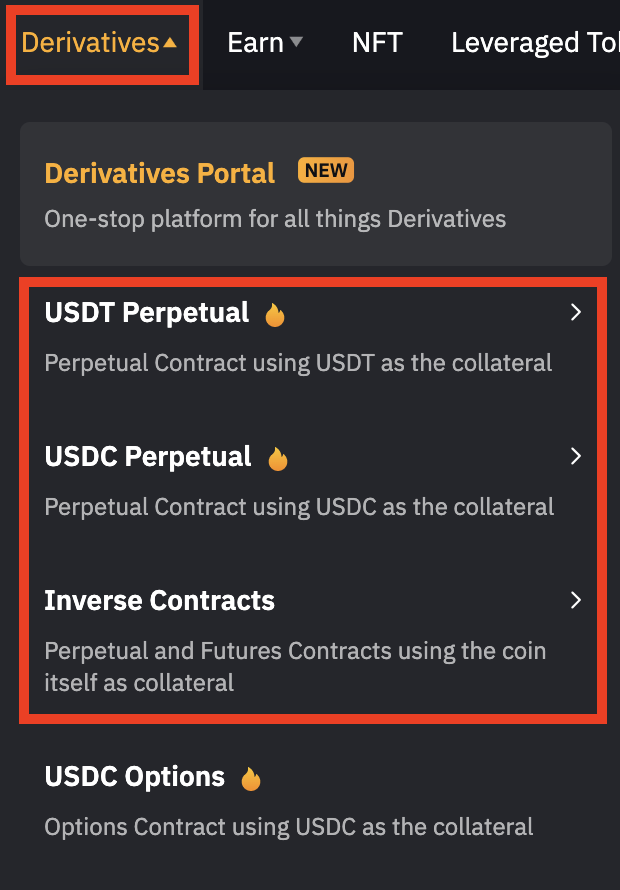

1. Log in to Bybit ➡︎ [Derivatives] ➡︎ Select Futures Contract

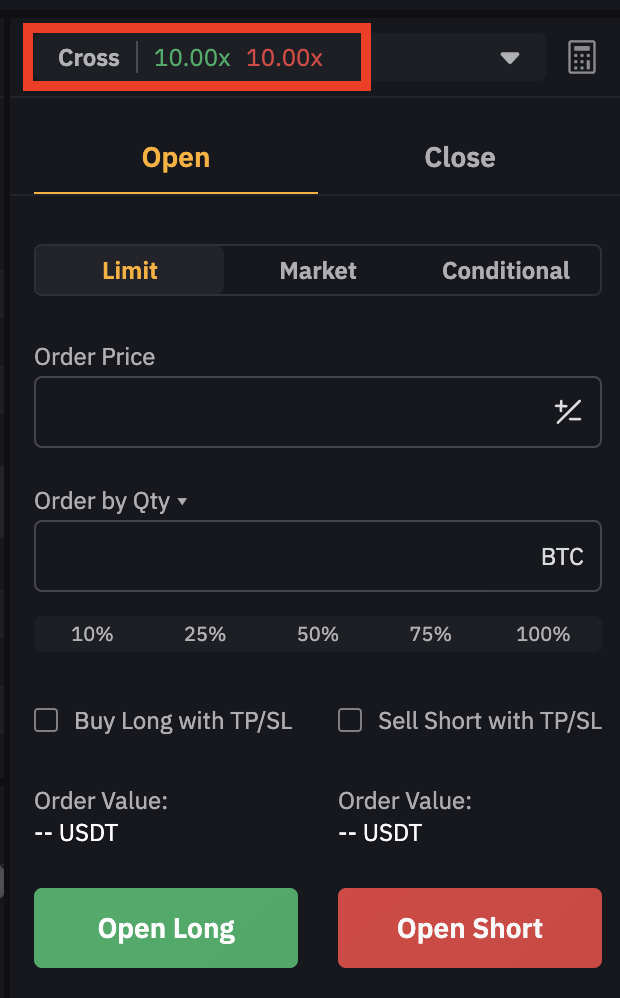

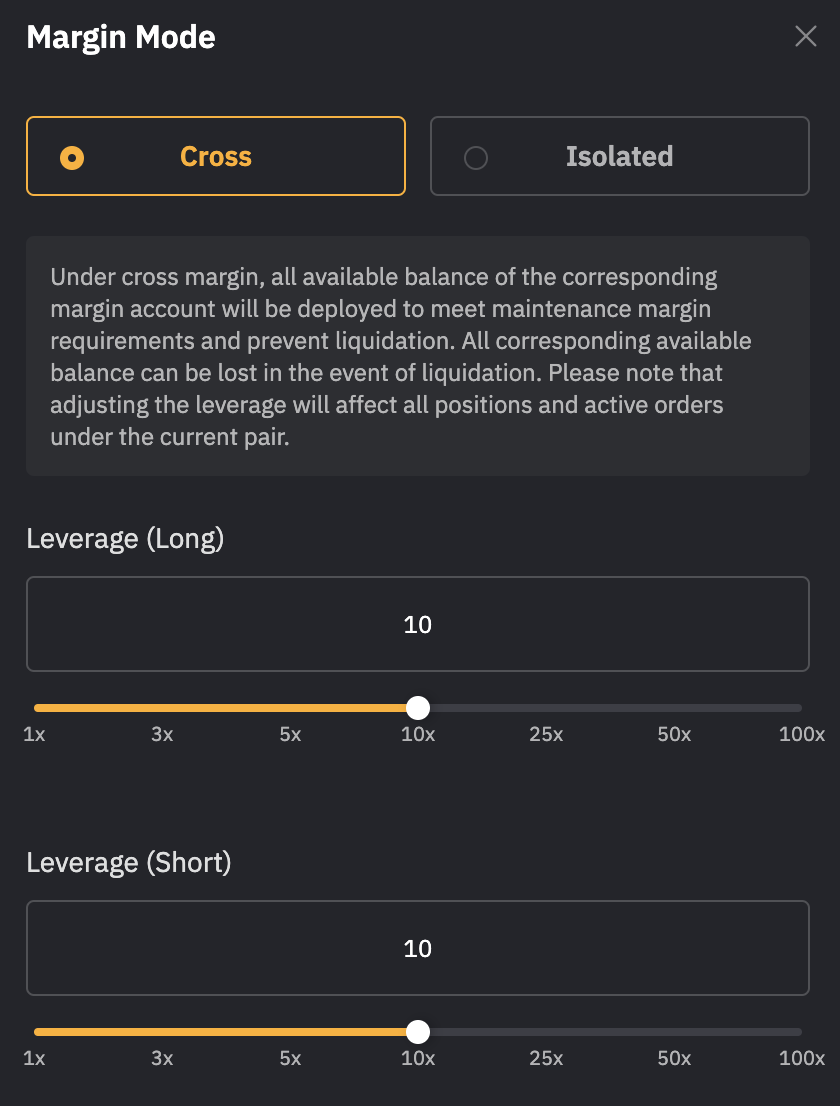

2. Set Margin Mode [Cross/Isolated] ➡︎ Adjust Leverage

Cross Margin : Collateral under the Cross Margin mode is shared by all positions under an account, and backed by all the account’s available balances.

Isolated Margin : Collateral under the Isolated Margin mode is available for a single position only. It’s isolated from other account positions, and is backed by a separate margin account balance.

3. Open and Monitor Position

4. Close Position

|

2021년 해외코인거래소 순위 및 추천 |

|||

|

|

|

|

|

|

거래량 |

11조(1위) |

3.5조 |

9.5조 |

|

레버리지 |

최대100배 |

최대100배 |

최대125배 |

|

수수료 |

- 지정가 : 0.02% - 시장가 : 0.04%(1위) |

- 지정가 : -0.025% - 시장가 : 0.075% |

- 지정가 : -0.025% - 시장가 : 0.075% |

|

거래방법 |

현물+선물+마진 |

선물+주식+FOREX |

선물 |

|

회원가입

|

|||

|

할인코드

|

|||